Explore the strategic power of moving averages in financial analysis: Unveiling advanced techniques for informed decision-making.

What is moving average?

The moving average (MA) is a simple technical analysis tool or an indicator that analyzes the trends and strengths of the market. It is a tool that calculates the average closing prices over a certain period of time, like 10 days, 20 days, 15 minutes, etc., or any other trader's chosen period. For example, a five-day simple moving average (SMA) calculates a daily average by summing up the last five closing prices and dividing the total by five. These daily averages are linked, forming a continuous line or a chart.

The MA is a simple indicator that shows the direction of the price movement at a glance, making it a popular tool for beginners.

Setting the MA period

The MA can be set and displayed according to the chart's time frame, so if the chart is set to 20 days, it will display the 20-day MA. This means that the MA indicator can be set to match your analysis needs and time frame preferences. As the period can be set to any length you like, many investors often ask which one is the most convenient. Let’s share our views regarding this.

Investor psychology often influences market movements, and this is the most crucial aspect a trader must consider when setting up a MA period—choose the ones most traders use.

Which MA periods you should use depends on your trading style, but the popular ones are 5d, 10d, 14d, 15d, 20d, or 21d MA for short-term trading, 50d, 60d, or 75d MAs for medium-term trading, and 100d or 200d MAs for long-term trading.

Suggested period for day trading

Day trading involves buying and selling a financial instrument within the same day, with all positions closed before the market concludes its daily trading session. For day trading, we should analyze the trend using the 1-hour or 4-hour moving average and determine the entry time using the 5-minute or 15-minute moving average. The recommended analysis method uses short-term MA (for example, 5d, 10d, 14d, 20d, or 21d bars) to identify the short-term trend on the 1-hour or 4-hour chart and a medium or long-term moving average (50d, 60d, or 75d bars) on the 5-bar or 15-bar chart to determine the entry point.

Suggested period for swing trading

Swing trading, a form of fundamental trading, involves holding positions for more than a day. Traders aim for short-term profits by utilizing technical analysis to enter, hold for days or weeks, and exit promptly. For swing trading, we should analyze the trend using a daily or weekly chart and determine the entry time using the 1-hour or 4-hour Moving Average. The recommended analysis method uses a short-term Moving Average (for example, 5d, 10d, 14d, 20d, or 21d Moving Averages) to identify the short-term trend on a daily/weekly chart and a medium- or long-term Moving Average (50d, 60d, 75d, 100d, or 200d bars) on the 1-hour or 4-hour chart to determine the entry point.

Set the MA period of the J. Granville Rules

The J. Granville Rules, after J. Granville, who created this method, use the 200-day Moving Average, so this is the period we should use in this type of analysis. However, there are some other periods too, and we can use them to analyze the relationship between the price and the Moving Average.

Changing the moving average period

Here we explain how to change the Moving Average period on the MT4 (Meta Trader4) and MT5 (Meta Trader5) platforms

MT4 (Meta Trader4)

This is what you must do to change the moving average period on MT4 (MetaTrader4):

Open MT4 (MetaTrader4) and select "Insert." → "Technical Indicators" → "Trend Indicators" → "Moving Average"

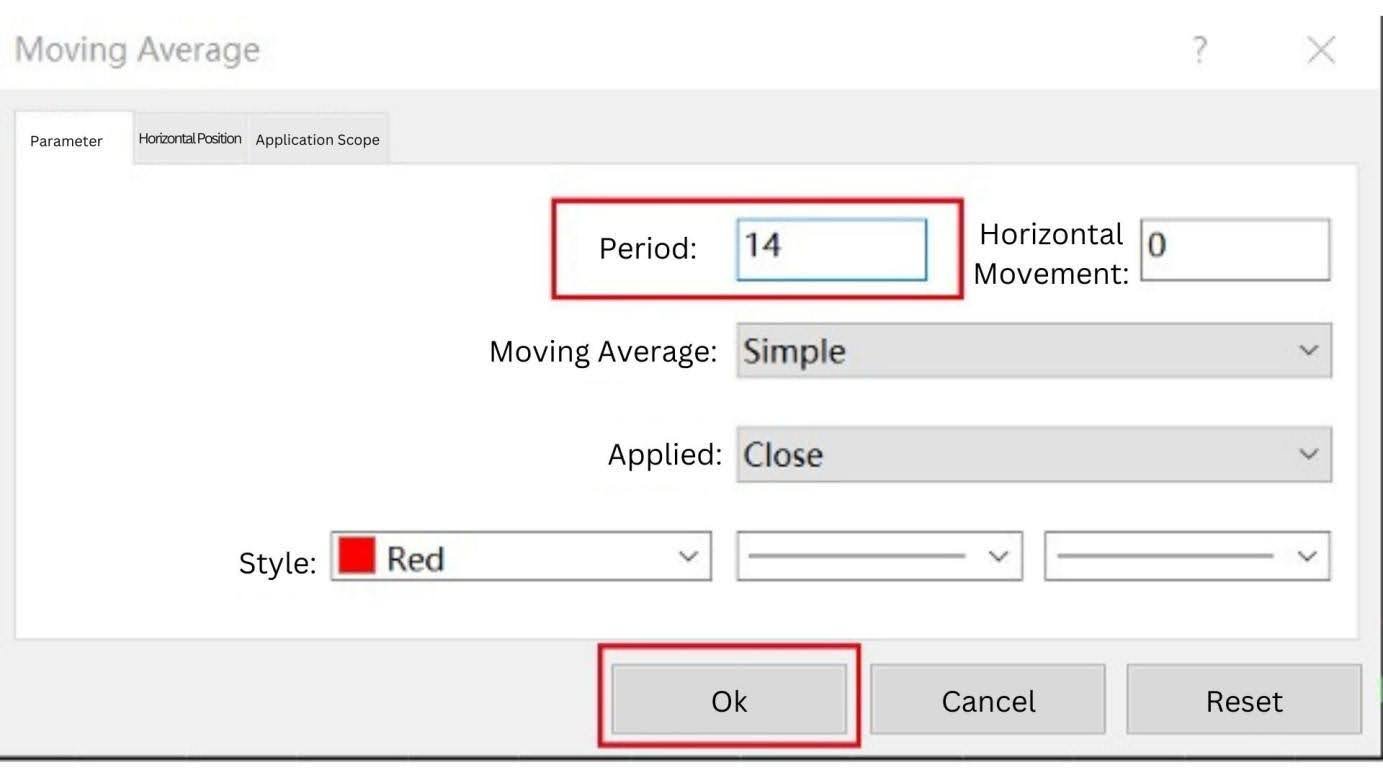

Once the setting interface appears, change the value of the period and press "OK" to confirm

MT5 (MetaTrader5)

This is what you must do to change the moving average period on MT5 (MetaTrader5);

Open MT5 (Meta Trader5) and select "Insert" → "Indicators" → "Trend" → "Moving Average"

Once the setting interface appears, change the value of the stage (period) and press "OK" to confirm.

Tips for setting the moving average period

One thing is certain: there are no winning methods or indicators in forex trading, and moving averages are no exception. While in the above section we introduced the recommended periods for setting the moving average, it is crucial to note that there is no ‘one size fits all’ solution.

To invest in forex long-term, you should adapt to the changing market conditions. Therefore, the moving average period should also be changed in line with market conditions, your trading style, your preferred trades, and other factors.

Try various moving average periods on the chart you are analyzing to find out which moving average period works for you. Try to figure out which period you must choose for your chart.